Unlocking Capital Efficiency: Providing Insights on CRR III’s Enhanced Capital Requirements and New Capital Optimisation Strategies

Maximizing shareholders’ returns by improving return on equity (RoE) is a core objective for banks. This requires effective risk management through optimising risk-adjusted returns via strategic growth, pricing, cost efficiencies, and minimising losses. Effective risk management is critically influenced by regulatory requirements, advanced modelling, and data. With CRR III on the horizon, banks face increased pressure to ensure compliance and optimize risk-weighted returns. These regulatory changes introduce more granular risk-sensitive risk-weights for various exposure classes under the Standardised Approach (SA).

This paper will examine the Corporate exposure class under SA, illustrating the transition from CRR II to CRR III and its impact on capital requirements (Chapter 1), as well as how these changes affect a bank’s capital optimisation and pricing flexibility (Chapter 2). The focus of this paper will be on the SA. However, it should be noted that with the introduction of the output floor, the SA also impacts banks utilising the Internal Ratings-Based (IRB) approach.

Additionally, this paper will analyse the effects of new capital optimisation strategies under both CRR II and CRR III within a closed regulatory environment, assuming no changes to the new regulation (Chapter 3). The construction of the analytical tools used in this study, and how it can benefit your organisation, will be discussed in the appendix.

Triple A offers banks the expertise and tools to navigate these complex changes efficiently. Leveraging our extensive experience in banking and in-house Basel Analytics tooling, we collaborate with clients to achieve capital efficiency under both the new CRR III framework and the existing CRR II regulation.

1. Introduction to the New Risk Weights Modifications for Corporate Exposures under CRR III

CRR III introduces significant modifications to the existing SA framework, making it crucial for SA banks to understand these changes thoroughly.

To illustrate the modifications introduced by CRR III to the risk-weights within the current prudential framework, a comparison of risk-weight flowcharts for Article 122 – Exposures to Corporates is presented. Key changes include:

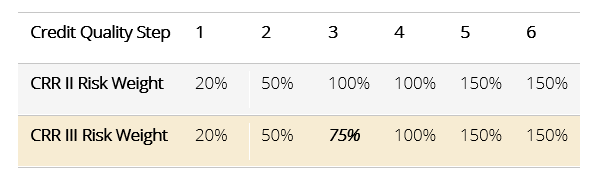

- Granular Approach: CRR III adopts a more detailed approach in splitting risk-weights for credit quality steps (CQS), particularly impacting the third CQS (BBB+ to BBB- rating by Standard & Poor’s). The risk-weight for corporates in this category is reduced from 100% to 75% (Table 1).

Table 1: Change from CRR II to III in the CQS Table (Table 6).

- Specialised Lending: CRR III introduces a new exposure class under Article 122a, covering Object, Commodities, and Project Finance, with specific risk-weights (Picture 1). This classification was not separately identified in CRR II, where such exposures followed the general corporate risk-weight structure.

These changes reflect a nuanced approach to managing risk-weights, aligning regulatory requirements more closely with evolving risk profiles. The impact of these adjustments is demonstrated in the calculation examples provided in the next chapter.

2. Insights on the Capital Impact of Transitioning from CRR II to CRR III

To assess the impact of transitioning from CRR II to CRR III, a dummy dataset comprising corporate loans exceeding EUR 1 million was constructed. Key metrics, including credit quality distribution, geography, and maturities, were benchmarked against a standard ETF[1]. The portfolio encompasses 5,000 loans and credits with an aggregate exposure of EUR 10 billion, covering both on-balance and off-balance exposures such as term loans, revolving credit facilities, and credit lines. For illustrative purposes, a distribution of 70% on-balance (EUR 7 billion) and 30% off-balance (EUR 3 billion) exposures has been employed. The analysis is conducted at the individual loan component level to offer an accurate perspective on the impacts of capital optimisation, taking into account the variations in loan sizes.

The Basel Analytics Tool enables comprehensive impact assessments by allowing the simultaneous evaluation of various exposure classes, capital optimisation strategies, and regulatory requirements. However, the dataset was maintained unchanged, with no data optimisation strategies applied, to isolate the impact of the transition from CRR II to CRR III.

With the transition from CRR II to CRR III, significant changes are noted in the revision of risk-weights for CQS 3 under CRR III. Additionally, revisions to the Credit Conversion Factors (CCF) for off-balance sheet items have been implemented under CRR III. Specifically, the CCF for unconditionally cancellable commitments has been increased, and a new 40% bucket has been introduced for certain commitments, replacing some of the previous 20% or 50% CCF classifications under CRR II. For example, undrawn commitments now have a 40% CCF under CRR III, compared to 50% under CRR II.

The results of this analysis, detailed in Table 2, highlight the changes in capital requirements and their implications on pricing headroom.

[1] For the creation of the dummy dataset, we made use of BlackRock’s ‘iShares Euro Investment Grade Corporate Bond Index Fund (IE)’.

Table 2: Capital Impact of Transitioning from CRR II to CRR III.

In the calculations, a CET1 target of 12.5% is assumed, reflecting typical industry benchmarks, though an actual CET1 ratio of 15% is common among banks in Europe. A higher CET1 ratio results in greater pricing headroom, which in turn increases the opportunity costs. A 10% RoE target is employed, although higher RoE targets, such as 14%, will also lead to increased opportunity costs.

As anticipated, the average Risk-Weighted Assets (RWA) for standard corporate exposures decreased from CRR II to CRR III due to changes in the Credit Conversion Factors (CCF) and risk-weights for CQS 3, which is a prevalent CQS for corporate exposures. This reduction in risk-weight lowers the required return, allowing banks to either offer more competitive loan terms or enhance their returns. This is illustrated in the column for ‘Pricing Headroom (in % of exposure)’, which shows that under CRR III, banks can either offer more competitive loan terms or increase the bank’s return by 5 basis points. The impact analysis, combined with the effects of introducing Specialized Lending (as discussed in the Supplementary Insight), underscores the need for a robust implementation strategy for CRR III.

Table 3: Capital Impact of Specialised Lending under CRR III, Compared to a Corporates Exposure with a 100% Risk-Weight.

3. Insights on the Impact of New Capital Optimisation Strategies under either CRR II or CRR III

In addition to the significant capital impact resulting from the transition from CRR II to CRR III, it is also crucial for a bank to gain insights into the effects of specific capital optimisation strategies within a closed regulatory environment, whether under CRR II or CRR III. Strategies such as entering ratings, ensuring guarantees are complete, and verifying collateral data delivery enable effective capital optimisation.

To narrow down and clearly define the impact of different capital optimisation strategies, the analysis utilized the same dataset as in Section 2, concentrating specifically on the Corporates exposure class and one single optimisation strategy: increasing the percentage of corporate loans with an assigned rating from 30% to 60%. In the base case, 30% of the loans have an assigned rating, while in the optimised scenario, this proportion is increased to 60%. The rest of the assumptions (like the CET1 target ratio and RoE target) remain the same.

This focused approach demonstrates the tool’s capability to assess impacts at a detailed level and evaluate various data dimensions. The analysis is divided into two components: comparing the base case to the optimised capital case under both CRR II and CRR III.

A. Evaluating Risk-Weighting and Capital Optimisation under CRR II

This assessment focuses on the impact of increasing the percentage of corporate loans with a rating from 30% to 60% on RWA and optimisation, following CRR II SA risk-weight calculation rules. Ultimately, a total price reduction of 10 basis points can be achieved, as the equity portion decreases by EUR 85 million on a total exposure of over EUR 8 billion. This reduction can result in additional capital gains or lower pricing, providing a significant competitive advantage in the highly competitive corporate loans environment where every basis point matters.

Table 4: Capital Impact of Increasing the Entered Ratings under CRR II.

B. Evaluating Risk-Weighting and Capital Optimisation under CRR III

The previous analysis is replicated under the CRR III regulation to assess the impact of increasing the percentage of corporate loans with an assigned rating from 30% to 60%. The revised risk-weight for CQS 3 under CRR III substantially heightens the significance of capital optimisation for a Corporate exposures portfolio. The equity requirement decreases by EUR 122 million on a total exposure of over EUR 8 billion, leading to a total price reduction of 15 basis points — an improvement greater than the reduction achieved under CRR II.

Table 5: Capital Impact of Increasing the Entered Ratings under CRR III.

Conclusion: Unlocking Capital Efficiency under CRR III

Maximizing shareholder returns and RoE requires effective risk management, driven by regulatory requirements, advanced modelling, and high-quality data.

As CRR III and CRR III approach, banks must refine risk-weight assessments and adapt to new regulations, including the output floor’s impact on the IRB approach. This paper analyses the Corporate exposure class to illustrate the effects on capital optimisation and pricing.

Risk-Weights Modifications (Chapter 1)

- Granular Approach: CRR III introduces a more detailed risk-weighting for credit quality steps (CQS), notably reducing the risk-weight for the third CQS (BBB+ to BBB-) from 100% to 75%.

- Specialised Lending: New exposure classes under Article 122a for Object, Commodities, and Project Finance have specific risk-weights not identified in CRR II.

Impact Analysis

- The discussed changes from CRR II to CRR III lead to a decrease in CET1 capital for the Corporates exposure class, providing extra pricing headroom of 5 bps to banks (Chapter 2).

- Increasing rated corporate loans from 30% to 60% results in an 10 basis point price reduction under CRR II optimisation, with a EUR 85 million decrease in equity on over EUR 8 billion exposure (Chapter 3).

- Under CRR III optimisation, this adjustment yields a 15 basis point reduction and a EUR 122 million decrease in equity, surpassing CRR II outcomes (Chapter 3).

Strategic Implications

- Data Optimisation: Increasing the amount of data elements will lead to effective capital optimisation.

- Competitive Advantage: Lower RWA and required returns offer banks a competitive edge, enabling better RoE or more attractive loan terms.

Conclusion

Navigating CRR III’s changes, including Specialised Lending, requires a robust implementation strategy. Triple A provides the expertise and tools needed for banks to achieve optimal capital efficiency. For further information on how this tool can benefit your organization or to explore additional insights it can provide, please contact the authors directly. We are available to discuss how the Basel Analytics can be tailored to meet your specific needs.

Appendix: Basel Analytics – A Game-Changer in Capital Optimisation

Like we saw in the previous chapters, the Basel Analytics Tool, developed in-house at Triple A, is designed with two primary objectives.

- First, the tool ensures that the impact of migrating from CRR II to CRR III is quantifiable, providing banks with the necessary business steering insights and helping the institutions to avoid unexpected outcomes (Chapter 2).

- Second, it provides insights into capital optimisation strategies by leveraging optimal data input (Chapter 3). The tool enables a clear understanding of the effects on risk-weights, the accompanying RWA, and equity levels when specific data elements are optimised, leading to concrete opportunities for lowering RWA and achieving more optimal risk-based returns.

To achieve optimal results with the tool, Triple A provides a comprehensive solution comprised of three key phases:

Dit artikel is geschreven door Rob Balk, Matthijs Leegstra en Cas Haex

-

-

Wilt u meer informatie of een afspraak maken?

Neemt u dan contact op met Rob Balk

© 2025 AAA Riskfinance. Alle rechten voorbehouden.