Credit Insurance: A Tool for Risk Mitigation and Capital Optimisation under Basel IV

Introduction on Credit Insurance for Credit Risk Mitigation Purposes and Article 506 of CRR III

Last week, the European Banking Authority (EBA) published its Report on Credit Insurance (October 2024), in response to Article 506 of the CRR III[1]. Article 506 mandates the EBA to provide guidelines on the use of Credit Insurance (CI) as Unfunded Credit Protection (UFCP). When a bank purchases CI, it transfers the credit risk of a loan or portfolio of loans to an insurer. This transfer reduces the risk weight (RW) of the insured exposures, resulting in lower risk-weighted assets (RWA) and potentially lowering capital requirements, thus improving capital ratios. However, this new Report on Credit Insurance and Basel IV introduces new regulations that challenge this form of capital optimisation.

Regulatory Arbitrage in Credit Insurance

The old form of CI could favour regulatory arbitrage, which occurs when banks exploit differences in capital requirements by using CI to lower their regulatory capital without reducing actual risk. Though the bank’s regulatory capital requirements may decrease due to the insurance, the credit risk is merely transferred from the bank to the insurer rather than eliminated. This creates an imbalance between perceived and actual risk.

New Measures to Challenge the Use of Credit Insurance for Regulatory Arbitrage

- Risk Weight Floor on UFCP

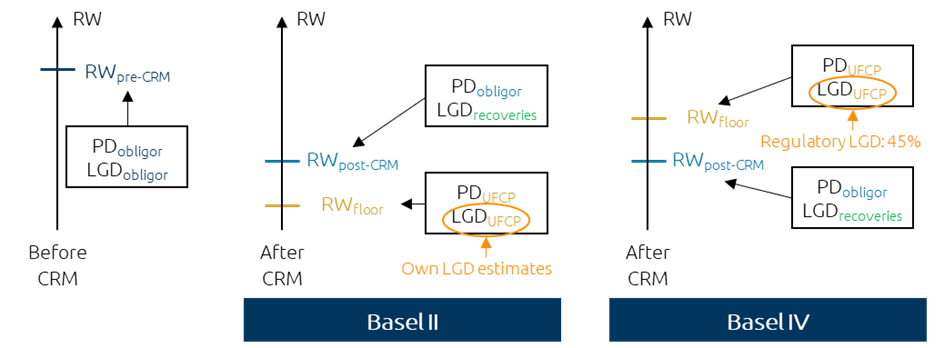

Basel IV imposes a RW floor for UFCP, limiting the capital benefits institutions gain from using CI. The RW floor prevents banks from undercapitalization because of recognizing both the double default effect[2] and the dual recourse benefit[3]. As a result, it no longer allows banks to account for the fact that both the underlying exposure and the protection provider must default for a material loss to occur. Reason for this is the lack of any such double default event, making it unfeasible to calculate the correlation between recoveries from both the obligor and the protection provider. Despite the changes, regulators considered that the new RW floor should still be lower than the weights applied to unprotected corporate exposures, thereby preserving some level of capital relief (as visualised in Figure 1). Note that the RW floor is applied to UFCP in general, thereby it does not put CI at a disadvantage compared to other forms of UFCP. All UFCP remain on equal footing with respect to the application of the floor and the non-recognition of dual recourse.

[1] Capital Requirements Regulations III, 31st of May 2024, Article 506 ‘Credit risk — credit insurance’.

[2] Double default is understood to be the risk-reducing effect that results from considering that the default of the obligor and the default of the insurer are events that are not fully correlated with each other.

[3] Dual recourse implies that an institution can reduce its losses by legally and simultaneously having claims on both the obligor and the insurer.

Figure 1: A schematic representation of the recognition of UFCP under Basel II and Basel IV [4]. LGDUFCP changes from own LGD estimates to a conservative LGD of 45% resulting in a RWfloor larger than RWpost-CRM.

[4] Note: Assuming own LGD estimates are used and lower than the supervisory-prescribed LGD of 45%.

2. Restricted Use of Own Loss-Given-Default (LGD) Models under the F-IRB Approach

The 2nd measure reducing the benefits of CI removes an institutions’ ability to use their own LGD estimates for CI-secured exposures under the F-IRB approach. Instead, it sets a fixed regulatory LGD of 45% for credit insurers. This more conservative LGD has raised concerns in the banking sector, as it limits potential capital relief. Despite industry requests, the EBA ultimately chose not to adopt a lower LGD for exposures backed by credit insurance. This decision was informed by input from the Global Credit Data (GCD), which showed significant variability in LGD estimates across institutions for the same credit insurers. While GCD data indicate that the average LGD estimates are near the regulatory LGD of 45%, the high volatility in estimates points to modelling difficulties and justifies the conservative stance according to the EBA.

Implications of Credit Insurance Under the Standardised Approach (SA) in CRR III

Under CRR III, institutions following SA can continue to recognize UFCP by applying the RW of the protection provider to the secured portion of an exposure, a process known as RW substitution. This RW substitution for the portion of the SA exposure covered by credit insurance, is done by using the RW derived under SA. This is regardless of how the institution treats a direct exposure to the protection provider[5]. Therefore, banks that are risk weighting credit insurers like Financial Institutions according to either F-IRB or SA, will have to apply the SA RW to the secured part of the exposure.

[5] Opinion of the European Banking Authority on the treatment of credit insurance in the prudential framework, 9th of May 2020.

Dit artikel is geschreven door Rob Balk en Robert Jan Sopers

-

-

More information or a conversation with us?

Please contact Rob Balk

© 2025 AAA Riskfinance. All rights reserved.