SDG Integrated Investing

The widely endorsed “Sustainable Development Goals” (SDG) by financial institutions are an important milestone in achieving environmental, social and governance (ESG) progress.

It is no longer sufficient for financial institutions to declare their alignment with SDG. The stakeholders of pension funds, insurance companies and banks require a product or service that is inextricably and explicitly linked with how we, as a society, are going to cope with the upcoming transition. Put it simply, the stakeholders require SDG goals to be a core integral part of the product.

Regulation is catching up with the demands from society, as from 2021, the new EU Taxonomy will be playing a major role in the transparency towards this agenda. Building SDG into the processes as an integral part can take more than one form. Financial institutions can:

- Invest in solutions

- Invest in companies that demonstrably contribute to the goals

- Act as a committed shareholder in the companies invested in

- Promote the conditions for progress in a dialogue with stakeholders

SDG and Financial Performance

Achieving SDG while maintaining the financial performance requires a forward-looking approach in this transition.

Reliance on historical patterns can no longer be taken for granted, not least because the very structure of the economy is undergoing a rapid and seismic change.

A forward-looking approach incorporating SDG must be used in all activities:

- Managing liabilities and assets by considering future (transition) scenarios

- Determining the impact of the transition on sources of risk and return for all asset categories and liabilities

- Evaluating the contribution and progress towards SDG of all issuers (companies and governments) in your portfolio

- Ensuring the appropriate SDG-related decision-making and results at all third-party providers

A Multi-faceted Problem Requires a Collaborative Solution

LINKS Analytics, Innorbis and Triple A – Risk Finance have jointly developed a proposition to support this forward-looking approach required to integrate SDG in the investment policy and process.

Goals and assumptions

Strategic session to support the board in formulating a view and beliefs on SDG

Strategic Investment plan

-

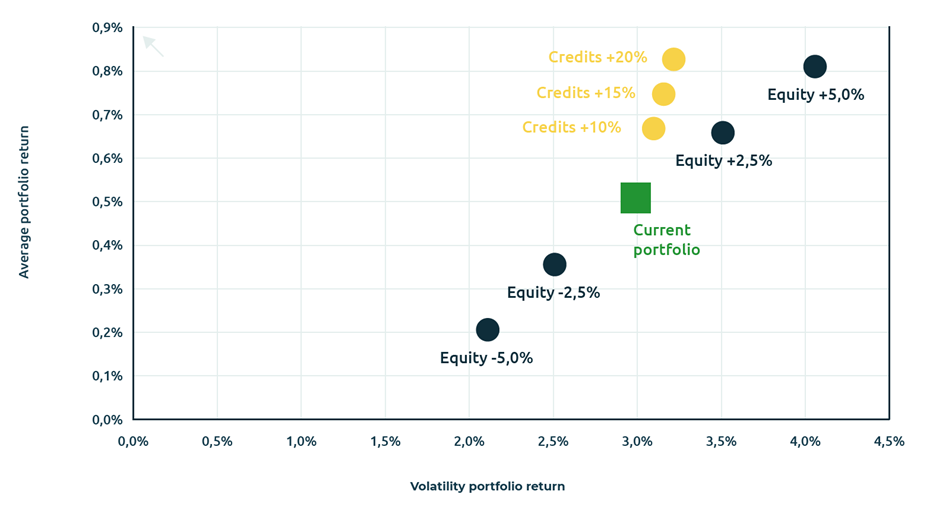

- Forward looking scenarios: central path based on the expectations and assumptions of the client, including SDG impact and stress-tests based on current economic conditions;

- Evaluate and improve your current portfolio, ESG profile and benchmarks in relation to SDG ambitions;

Implementation and Outsourcing

-

- ESG integrated portfolio construction; estimation of the financial cost or benefit of moving to the better target ESG performance in terms of expected long-term return and stress scenarios;

- Guidance and coordination with asset managers to construct, report and implement ESG adjusted indices.

Monitoring and Execution

-

- Monitor the SDG performance of your portfolio on a regular basis compared to chosen benchmarks;

- Report on EU Taxonomy valuation and compliance towards the new regulation for reporting purposes and disclosures.

Evaluation and Adjustment

Regular evaluation of SDG performance and adjustments to the strategic investment plan if required.

Innorbis provides accurate and reliable measurement of the current progress of companies and institutions with respect to SDG and is able to report on EU taxonomy valuation and helps being compliant towards the new regulation for reporting purposes and disclosures

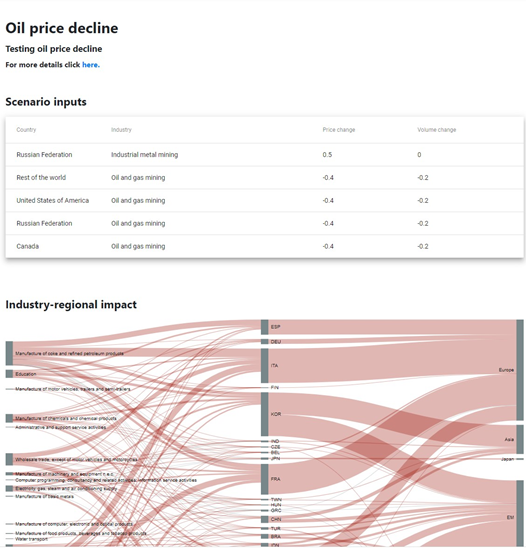

Using its proprietary Mira Agent-Based Modelling framework, LINKS Analytics provides the translation of SDG data into expected asset class returns and the future macroeconomic environment.

At the strategic level, the alliance provides institutional investors with forward-looking scenarios that take into account transition pathways. The scenarios (including the base case scenario) can be tailor-made based on client views and expectations. This provides seamless integration of ESG related risks into forward-looking analyses; such as ALM and ORSA calculations done by Triple A – Risk Finance.

Technology: integration of solutions

Companies, institutions, and countries are monitored using approaches that can measure the behavior and realized progress based on open source sustainability measurement units.

The technique measures real progress and is not a normative tool for ranking companies or institutions. By measuring the real progress, it is possible to capture the real transition value of companies and institutions:

- continuously updated data

- aggregated using the most rigorous approaches

- from multiple well-regarded sources (incomplete list):

The platform enables institutions to go beyond the dialogue phase and contribute to the actual realization of the SDG and sustainable agenda through targeted investments. Main characteristics of the technology are:

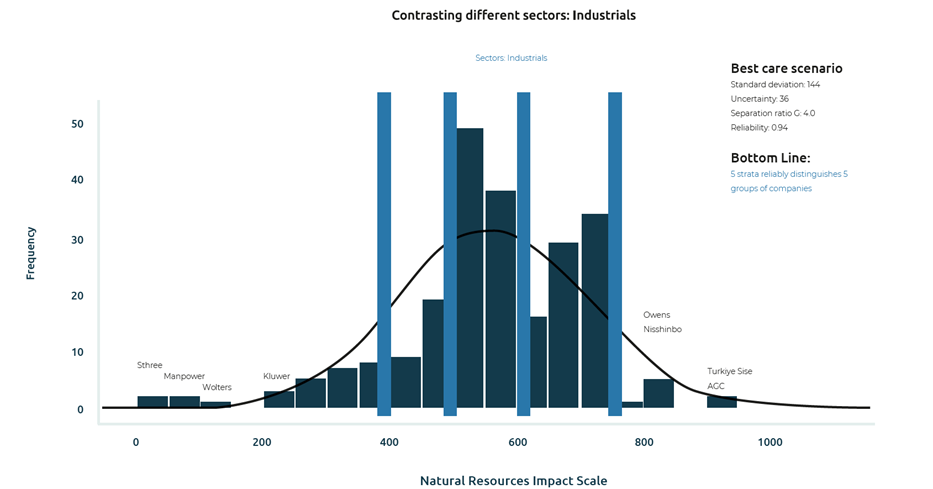

- Measurements designed from rigorous scientific theory

- Relevance and meaningful materiality attributed into a ruled based process

- Systems with calibrated standard units of sustainability progress

- Scale with interval properties and reliability level per industry and region

- Always associated with stated uncertainties, traceability and transparency

- Quality assured by an independent authority

Our solution offers you the necessary tools to integrate SDG into your entire investment cycle and take care of all your worries with respect to SDG and investing. Together we will be able to make the world a better place.

-

Verder praten met

Triple A? E-mail

020 - 707 3640

Spreken onze thema’s jou aan en is onze cultuur precies wat je zoekt? Kijk dan eens bij onze vacatures. Wij zijn altijd op zoek naar talent!

-

-

Wilt u meer informatie of een afspraak maken?

Neemt u dan contact op met Ridzert van der Zee

© 2025 AAA Riskfinance. Alle rechten voorbehouden.