The Impact of ECB’s BIRD Initiative – Working Towards the Data Driven Bank

The rapidly evolving banking sector is increasingly confronted with significant challenges in data management, particularly in the areas of, storage, regulatory reporting, and compliance. With the European Central Bank’s (ECB) introduction of the Banks’ Integrated Reporting Dictionary (BIRD) and the anticipated implementation of the Integrated Reporting Framework (IReF) by 2027, banking institutions must adapt their data management strategies to remain compliant and efficient. Due to the potential of these initiatives, we have committed to incorporate this into our proprietary Triple A BIRD platform. Additionally, we are participating in a workstream organized by the ECB focused on the development and implementation of BIRD, ensuring our solutions are aligned with the latest regulatory standards and practices.

BIRD, IReF and Its Connection

The Banks’ Integrated Reporting Dictionary (BIRD) and the Integrated Reporting Framework (IReF) are two major initiatives driven by the European Central Bank (ECB) that aim to modernize and harmonize regulatory reporting in the European Union. These initiatives are interconnected, with BIRD laying the groundwork for the successful implementation of IReF.

BIRD

BIRD is an ECB-led project designed to help banks meet their regulatory reporting obligations more efficiently by providing a standardized data dictionary. This dictionary outlines how banks should organize their data to comply with the various reporting requirements set by European regulators. BIRD’s primary goal is to reduce the complexity and administrative burden associated with regulatory reporting by ensuring that data is collected, processed, and submitted in a uniform manner. By offering detailed guidance on data modeling and reporting procedures, BIRD aims to enhance the accuracy and consistency of the data that banks submit to regulators.

IReF

IReF represents a broader effort by the ECB to consolidate multiple existing reporting frameworks into a single, integrated system. The aim is to streamline the collection of statistical, prudential, and resolution data from banks across the EU. IReF seeks to replace the fragmented and often inconsistent national reporting systems with a unified framework that applies uniformly across all EU member states. This integration is expected to improve the efficiency of data collection, reduce duplication of effort, and enhance the comparability of data across different jurisdictions.

Connection between BIRD and IReF

The connection between BIRD and IReF is both functional and strategic. BIRD serves as a foundational element for IReF by providing the standardized data definitions and models that are essential for the success of the integrated framework. In essence, BIRD is the “dictionary” that helps banks understand how to structure their data, while IReF is the overarching “framework” that dictates what data needs to be reported and how it should be used by regulators.

As IReF consolidates various reporting requirements into a single framework, the standardized approach promoted by BIRD ensures that banks can adapt more easily to these changes. The harmonized data structures and definitions provided by BIRD are critical for the seamless implementation of IReF, as they reduce the need for banks to reformat or reprocess data to meet new reporting requirements.

In summary, BIRD and IReF are complementary initiatives aimed at modernizing and simplifying the regulatory reporting landscape in the EU. BIRD provides the necessary tools and guidelines for consistent data management, while IReF consolidates and integrates the reporting requirements, creating a more efficient and standardized system for both banks and regulators.

Cost-Benefit Analysis of IReF

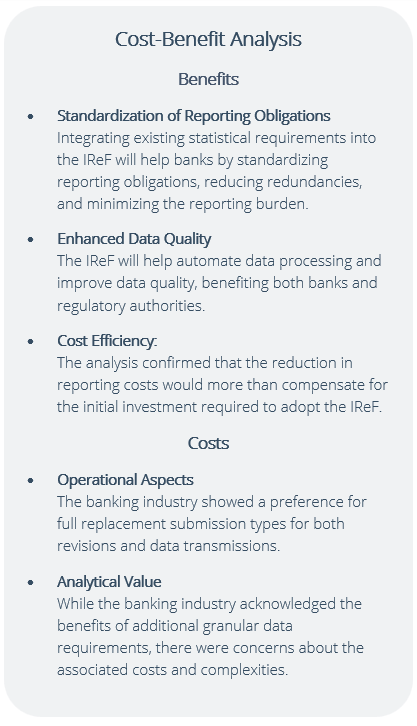

In recent years, the Euro system has conducted a comprehensive cost-benefit analysis (CBA) to assess the merits and features of the IReF. [1] This analysis involved close cooperation with the

banking industry and other stakeholders, including national central banks (NCBs) in the European System of Central Banks (ESCB). The outcomes of the CBA for the IReF are directly related to the incorporation of the BIRD Data Framework into banking data management. The cost-benefit analysis highlights several benefits of the IReF. Despite the overall positive feedback, the CBA also identified some challenges and areas for further investigation, shown in the textbox.

[1] www.ecb.europa.eu/stats/ecb_statistics/reporting

BIRD’s Online Platform

Our in-house BIRD platform is designed to analyze and evaluate data, as well as improving data quality. It provides automated checks and validations, enabling banks to detect and address data errors early in the reporting process. By integrating BIRD into this tool, we aim to extend its capabilities, offering a solution that not only adheres to traditional data models but also aligns with BIRD-compliant frameworks, like the transition to the IReF standards. Additionally, we plan to integrate risk analyses and calculations into the platform, allowing users to conduct key risk assessments directly on the data. This ensures not only high data quality but also robust risk management, minimizing the risk of costly reporting errors and regulatory penalties.

To ensure our solution is aligned with the latest regulatory standards and practices, we are participating in a workstream organized by the ECB focused on the development and implementation of BIRD.

Our platform ensures high data quality and robust risk management, minimizing the risk of reporting errors and regulatory penalties

BIRD Implementation

As regulatory demands evolve, the integration of BIRD into banking operations will likely become a standard practice. Our in-house data platform, with its BIRD integration, is positioned to be at the forefront of this transition. Our comprehensive approach ensures that banks can:

Seamlessly Transition: From traditional data structures to BIRD-compliant formats, with minimal disruption to their operations.

Maintain Compliance: With evolving regulatory standards, particularly as the IReF becomes mandatory.

Optimize Data Management: Through a robust platform that enhances data quality and reduces the complexity of reporting processes.

Conclusion

The ECB’s BIRD and IReF initiatives are essential for modernizing data management in EU banks. BIRD offers a standardized data dictionary, while IReF provides a unified framework for consistent and efficient reporting. By leveraging a platform, banks can adopt best practices like automated validations, data analytics, and visualization to enhance data quality and ensure compliance. This prepares banks not only for current regulatory demands but also for future requirements under IReF.

Dit artikel is geschreven door Robert Hoek, Daniël Mühren, Romy Mieras en Cas Haex

-

-

Wilt u meer informatie of een afspraak maken?

Neemt u dan contact op met Rob Balk

© 2025 AAA Riskfinance. Alle rechten voorbehouden.