Triple A’s Approach to Embedding Climate Risk in Financial Risk Modelling

The importance of physical climate risk assessments has significantly increased due to EU regulations. The ECB has mentioned, in direct correspondence with systemic banks, their expectation of derisking portfolios of climate risk and of active discussion of climate risk in client management. These regulations and ECB correspondence underscore the necessity for financial institutions to comprehensively evaluate and manage climate risks posed. This encompasses stress testing, reporting, portfolio management and capital adequacy assessments. In particular, challenges persist around the lack of standardised, transparent, and localised climate data. While physical climate risk solutions are available, these usually do not have granularity suitable to the market and come with black-box properties. This complicates compliance efforts, in addition to the challenge of combining all elements into a comprehensive framework.

Triple A addresses these challenges by providing tailored climate risk management solutions. We make use of local data to perform physical climate risk assessments in a transparent and granular manner, leading to monetary risk estimates. Leveraging on the CLIMADA engine enriched with local data, Triple A delivers granular and transparent physical climate risk assessments. These insights help institutions meet regulatory demands on risk management by enhancing asset pricing, collateral valuation, and capital adequacy processes.

This paper introduces Triple A’s approach and includes a case study on the impact of physical climate risk on a Dutch residential real estate portfolio, highlighting key challenges and opportunities in climate risk modelling.

Introduction to CLIMADA

It is necessary to utilize tooling that enables granular modelling of physical climate risks. CLIMADA, short for CLIMate-ADApt, is a leading tool for assessing physical climate risks. Developed through a partnership between the European Commission and the European Environment Agency, it provides a flexible framework in which climate, environmental, and financial data can be combined to estimate and manage the risks associated with floods, heatwaves, and other climate-related events. CLIMADA’s versatile platform allows users to gain more granular insights and perform scenario analyses, providing enhanced insights and awareness for more informed decision-making. By quantifying and managing financial risks associated with climate change, CLIMADA supports Europe in adapting to climate change and improving monitoring and planning efforts.

The challenge in successfully utilizing CLIMADA is twofold. Firstly in gathering, pre-processing, and implementing sufficiently granular data. Secondly in the post-processing and interpretation of the results and implementing these results in stress testing or scenario analyses. Large amounts of granular, environmental data are available on the well-documented Dutch environment. By incorporating the necessary expertise and knowledge on physical climate risk modelling Triple was able to utilize this data to introduce high levels of granularity to the climate risk analysis of CLIMADA, thus allowing more accurate financial risk estimates. These insights can be incorporated in scenario analysis, pricing, collateral valuation, and portfolio management for the benefit of risk management and compliance.

In the next chapter of this paper a case study is conducted to illustrate the possibilities of Triple A’s approach to physical climate risk modelling. Afterwards opportunities and challenges of integrating physical climate risk in financial modelling are discussed.

Case Study: Flood Risk in Limburg

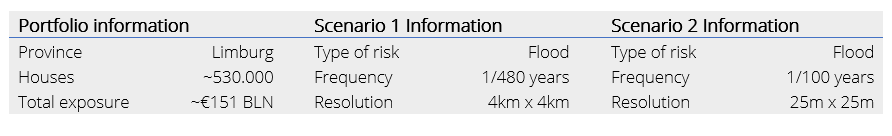

In this case study the financial impact of two flood scenarios on a real estate portfolio is assessed. To perform this assessment Triple A has combined multiple Dutch and international data sources, including scientific research results, within CLIMADA. First the two scenarios are described, followed by a description of the risk assessment and financial impact of climate effects. Next an analysis of the differences in granularity between the two scenarios is given and the benefits of an increase in granularity is discussed. Finally, the chapter concludes with remarks and suggested future steps.

Different Flood Scenarios

The first flood scenario is created by the Federal Institute of Technology Zürich using the Inter-Sectoral Impact Model Intercomparison Project (ISIMIP) according to the RCP6.0 climate scenario(1). It portrays a flood expected to occur with a 1 in 480 year frequency and is provided at a 4km x 4km resolution. The second flood scenario is created by the Dutch Landelijk Informatiesysteem Water en Overstromingen (LIWO)(2), and has an expected frequency of 1 in 100 years and a resolution of 25m x 25m.

(1) CLIMADA Datasets (ethz.ch)

(2) Kaarten (basisinformatie-overstromingen.nl)

The real estate portfolio consists of approximately 530.000 residential houses in the Dutch province Limburg. In the portfolio no distinction is made between different residential home types. The houses have their value estimated as the mean WOZ-value of their municipality, leading to a total portfolio value of approximately 151,- BLN EUR.

Risk Assessment

To perform our risk assessment Triple A has preprocessed and incorporated the two flood scenarios and the residential portfolio into the relevant CLIMADA modules(3). The first scenario was loaded through CLIMADA’s build-in API. For the second scenario Triple A performed pre-processing to ensure compatibility with CLIMADA whilst ensuring no informatio

n loss. Similarly, Triple A has processed the real estate portfolio to properly and completely load into the exposure class. Finally, an impact function, which is used to calculate the damage estimate, was defined by Triple A based on results from scientific research.

By mapping hazard and exposure information by geographical location an impact on each exposure is estimated using the impact function. Applying the first scenario, i.e., 1 in 480 yr, the estimated annualized damage on the portfolio is 274,- MLN EUR. The second scenario, 1 in 100 yr, results in an estimated annualized damage of 316,- MLN EUR. The asset-specific damage estimates are displayed in figures 1 and 2. The damage estimates vary due to differences in frequency and underlying assumptions in the scenarios.

The Effect of Granularity Differences

As seen in figure 1 the variance in damage estimates between nearby houses is severely limited, this is a direct result of the 4km x 4km granularity of the first scenario. On the other hand, results with extraordinarily high specificity were obtained using the second scenario, as seen in figure 2. Important to note is that the increased granularity has no effect on the total estimated financial impact of the flood scenarios. It merely has a significant positive effect on the possible use cases of the model.

(3) More information on the different modules of CLIMADA can be found in the appendix

With the increase in granularity the possibilities of interpreting and utilizing the financial impact of climate effects increase significantly. In the case of floods, the risks can

be assessed at a much more localized level, allowing for impact assessments on individual assets. This could also allow banks to measure the effect of forming an incentive for customers to adapt preventive measures in or near their homes, increasing their personal resilience against physical climate risks, whilst protecting their collaterals against damage. Furthermore, precise risk information can positively benefit long-term strategic planning, for example, in the deliberation and selection of optimal sites for new construction projects.

Case Study Conclusion

In the case study the impact of two flood scenarios on a residential real estate portfolio is estimated. The estimated financial impact is mostly dependent on the flood characteristics. However, the usefulness of the results is highly dependent on the granularity of the result, which is strongly affected by the granularity of the source data. We have shown that, using data-driven methods, it is possible to obtain granular, monetary risk estimates at the single asset level in a residential real estate portfolio. These precise results could be used both in small scale measures as well as in long-term strategic planning.

While not in the scope of this case study, a next logical step would be to perform similar analyses on a large array of scenarios and integrate the results into relevant risk management frameworks. Triple A’s expert risk managers have varied and extensive experience in the development and integration of risk models in systemic and non-systemic banks and other financial institutions.

Integration Opportunities for Physical Risk Assessment

While the case study represents an example of the possibilities of CLIMADA, it does not fully encompass the extensive integration opportunities available to banks and other financial institutions.

The ECB looks towards proper assessment of climate risk in their Strategic Supervisory Priorities. On the path to future regulatory compliance CLIMADA can be used to perform extensive scenario analysis of climate related risks such as, but not limited to, temperature shifts, rising sea levels, increased wildfires and changes in rain patterns (such as droughts or prolonged rainfall). As an example of the possibilities, Triple A created fig. 3, which resulted from integrating soil maps, land plot information and drought data in CLIMADA which was used to estimate the impact of climate change on agricultural yields of individual farm plots. The EBA sees climate stress testing as the most feasible short-term solution to incorporate climate and environmental risks (CER). Due to its flexible framework, CLIMADA can be utilized both for long term assessment of climate change and the assessment of short stress situations, such as the damage caused by a single wildfire, or the effects of a significant drought on crop yield. Incentives to implement climate scenario analysis and climates stress testing are not limited to regulatory pressure. Climate stress testing can additionally be a useful tool for improving portfolio allocation by better reflecting future climate risks in portfolio valuations and stress testing.

Conclusion

Regulators can, and likely will, require organizations to assess the effect of climate change on financial systems and evaluate responses to climate-related shocks. This involves testing how financial systems would respond to climate-related events, helping regulators and organizations prepare for potential shocks.

Through its adaptable and flexible framework, CLIMADA can be applied to several areas yielding beneficial insights in portfolio exposures. This holds in the area of risk assessment to quantify the probability and magnitude of local losses associated with physical climate-related events, which are translated into a monetary risk estimate.

The output of our risk assessment serves as input for scenario analysis or to perform climate stress testing to gain insights into the risks and vulnerabilities of a portfolio. This involves evaluating how different climate scenarios could affect collaterals and developing strategies to enhance resilience against these risks.

In addition, performing climate risk assessments provides new perspectives on the valuations of collateral. Through accurate assessments of physical climate risk impact on collateral, potential impacts of climate change can be accounted for in the valuation. This can have effects on pricing and capital allocation.

In order to achieve above mentioned insights extensive pre- and post-processing of data and adequate interpretation of results is required. Triple A can assist in each step of the analysis at an expert level.

Appendix A: Physical Climate Risk Methodology

CLIMADA consists of three key modules to call on and enable the assessment of physical climate risks: i.e. hazard, exposure and impact. These modules are connected using centroids, with this connection the total impact can be assessed. In this appendix the modules and the centroids framework are introduced.

Hazard Module

A hazard refers to events such as storms, floods, droughts, or heat waves, characterized by their probability of occurrence and location bound physical intensity. The hazard module serves as an input class to define these extreme events, incorporating essential attributes such as geographic location, intensity and frequency. This allows for the computation of impacts based on historical data or model simulations. CLIMADA employs stochastic events mirroring historical frequency and intensity to offer a probabilistic risk assessment, facilitating comprehensive analysis and supporting both deterministic and probabilistic evaluations.

Preventive measures can be incorporated in the hazard module through adaptation measures, which are strategies and actions taken to reduce the impact of physical climate risks, such as rigid building regulations or constructing protective barriers. Including these in the assessment will result in an accurate representation of the impact due to the mitigation of the physical climate risk.

Exposure Class

The exposures class covers the geographical distribution of monetary values or different assets. This involves mapping out where valuable assets (such as homes, infrastructure, etc.) are located based on their geographic location, enabling the estimation of impact caused by the physical climate hazard.

Impact Function

In the CLIMADA framework, impact functions, also known as vulnerability curves, are essential to quantify the relationship between hazard intensity and the resulting damage to exposed assets. Each impact function is tailored to specific hazard types and asset categories, such as buildings or infrastructure. By integrating these impact functions, CLIMADA can accurately assess potential losses and support effective risk management and adaptation strategies.

Centroids framework

In the CLIMADA framework the hazard module and exposure class are linked using centroids. These centroids represent the geographic points used to model the spatial distribution of hazards and exposures. Each centroid is defined by its latitude and longitude coordinates, and can include additional attributes such as elevation, distance to the coast, and whether it is on land or offshore. These centroids serve as the basis for mapping and analysing the impact of climate-related events on different regions. By using centroids, CLIMADA can accurately simulate the geographic spread of hazards and assets and assess the potential damage to assets within those areas. Additionally, the CLIMADA framework offers the possibility of implementing exposures as lines or shapes on a geographic map, enabling accurate modelling of roads, railways or fields.

Dit artikel is geschreven door Jelmar Faber en Roel Veth

-

-

Wilt u meer informatie of een afspraak maken?

Neemt u dan contact op met Rob Balk

© 2025 AAA Riskfinance. Alle rechten voorbehouden.